Summer is finally here, or is it? While summer doesn’t officially arrive until Tuesday, June 22, I’m using “Summer” in the name of this letter for two reasons: 1) by the time you read this, the summer solstice will have likely already occurred; 2) I’m looking beyond our seemingly endless spring (or, is it winter?!) with optimism and hopefulness that warm weather will finally arrive on the longest day of year! Regarding the summer solstice, I am always a little discouraged when I realize, just as warm weather arrives and my plans for summer fun begin, the days get progressively shorter. I still have a very hard time accepting this!

In our Winter 2022 letter, I wrote the following…

Following the market lows of March 2009, the S&P 500 has generated an average gain of 18.6% per year, which is well above the long-term average annual gain of 9.7% since 1927. This statistic alone suggests that the U.S. stock market cannot continue at the pace of the last 12+ years. There will be a reversion to the long-term average gain, and a reversion to the long-term average means there will be years in which the market produces returns which are significantly less than the long-term average, including negative returns.

Our Market Environment Indicator (MEI) turned negative last week, resulting in a reduction of market exposure and an increase of cash allocations in our tactical strategies. It is too early to tell if this is a false signal, if the market has entered a short-term correction, or if it is the beginning of a long-term bear market.

We now know the MEI reversal to negative in January was definitely not a false signal: Since the beginning of 2022, the broad U.S. stock market, as represented by the S&P 500, has lost over 23%. What we do not yet know is if this is merely a cyclical (short or intermediate term) correction, or the beginning something much worse and longer term. Like every other so called “expert” in this business, I don’t know! While I wish I could offer more encouraging news, I would be speculating and to paraphrase Mark Twain: June is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August and February.

If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes.[i]

Heeding the sage advice of Peter Lynch, I'll spend less than 3 minutes of your time telling you I believe the market is likely to get worse before it gets better. While there will certainly be short-term periods of positive performance, the overall trend of the market remains negative, i.e., the MEI has not yet signaled that it’s safe to increase market exposure. Until it does, we remain very cautious, with high cash balances and low market exposure in our tactical account investment strategies.

Inflation is always and everywhere a monetary phenomenon.[ii]

Moving on from the stock market to the economy, I feel compelled to write on the subject of “inflation.” I intentionally put inflation in quotes, as I believe the phenomenon of what is commonly called inflation is tragically misunderstood. I began this section with a quote from Nobel Prize winning economist Milton Friedman. I’d like to expand on Friedman’s claim by quoting my favorite economist, Ludwig von Mises, who may be the most hated and most understudied economist of all time, at least among today’s MMT-centric[iii] economists, whose radical theory may have irreversibly transformed U.S. government economic policies, with devastating financial consequences for American households…

Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check. But people today use the term `inflation' to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation…As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar. As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation.[iv]

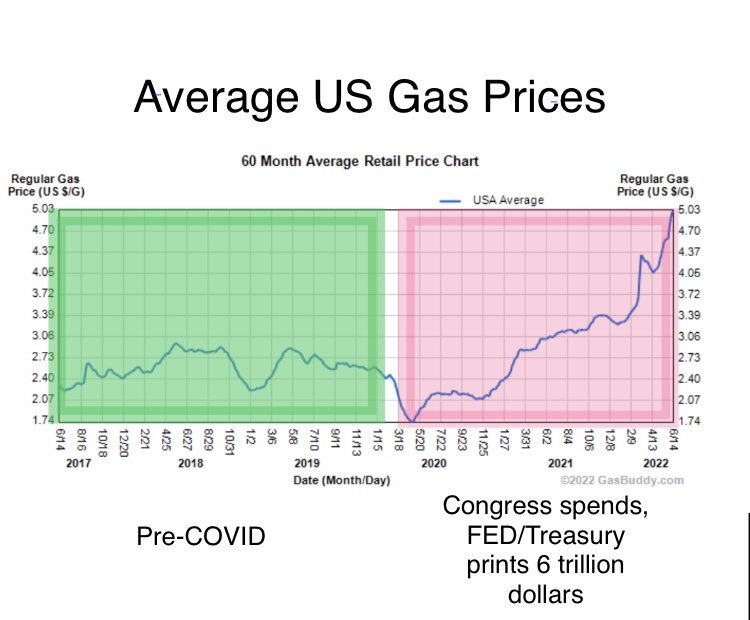

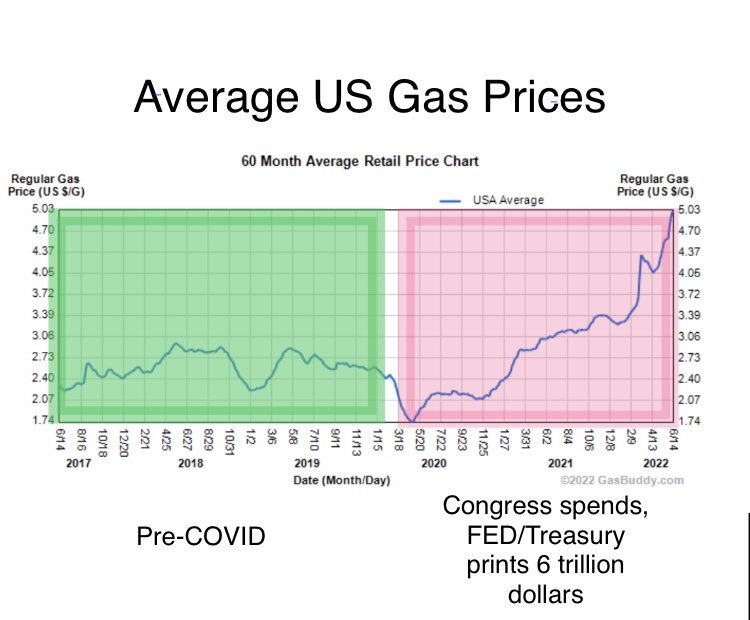

What von Mises was trying to explain is that inflation (an increase in the money supply) is the cause of rising prices vs. the phenomenon of rising prices. What people commonly call “inflation” today (i.e., rising prices) is actually the result of inflation (i.e., an increase in the money supply). This is a very important distinction, especially as America wonders, how did we get here? It seems quite evident that it did not start with supply chain issues or a war in Ukraine. To illustrate this, in the following chart note the exponential increase in gas prices corresponding with the unprecedented increase in federal spending (i.e., actual inflation, per Friedman and von Mises) beginning with the U.S. economic shutdown at the beginning of the Covid-19 pandemic…

Out of crisis comes opportunity. You make most of your money in a bear market; you just don't know it at the time.[v]

What might we expect to see, going forward? Remember, I don't know! However, ignoring the previously cited wisdom against speculation, it would seem that negative U.S. stock market performance is reflecting economic weakness which is now present and likely to get worse. In fact, some of those who keep close track of such things believe the U.S. has already entered an economic recession (two consecutive quarters of economic decline, as measured by GDP). If correct, stock market performance is likely to get worse before it gets better.

However, if the stock market follows the historical pattern, at some point in the future--likely in the midst of even worse economic news and, most importantly, when we least expect it--disciplined investors will look beyond the then present economic conditions and put money back into risk assets, expecting better returns in the future as the economy improves. This is the pattern I’ve witnessed countless times in over 32 years in the money management business. If this pattern repeats, I suspect it will not be immediately observable, let alone believable, and the majority of investors will be reluctant to commit investment capital. In the scenario I’m describing, I expect that demand for risk assets will slowly, quietly resume while the financial prognosticators are still talking about the end of the world! When this occurs, our Market Environment Indicator (MEI) will guide us, as it has so many times in the past. Until then, we remain cautious, hopeful, and entirely confident in the observation of Shelby Cullom Davis: Out of crisis comes opportunity.

Summer has arrived!

Sean Gross, CFP®, AIF® | Co-Founder & CEO

Sean Gross, CFP®, AIF® is the Co-Founder and CEO of Telos Wealth Management, LLC, a Registered Investment Adviser located at 656 North Miller St., Wenatchee, WA. Sean can be reached at 509-664-8844 or at

Info@TelosWealth.com.

[i] Legendary investor Peter Lynch, former manager of the Fidelity Magellan Fund, who is widely considered one of the most successful and well-known investors of all time.

[ii] Milton Friedman, “Inflation Causes and Consequences”, Asian Publishing House, 1963

[iii] Modern Monetary Theory (MMT) is a [non mainstream]…economic framework that says monetarily sovereign countries like the U.S., U.K., Japan, and Canada, which spend, tax, and borrow in a fiat currency that they fully control, are not operationally constrained by revenues when it comes to federal government spending. Put simply, such governments do not rely on taxes or borrowing for spending since they can print as much as they need and are the monopoly issuers of the currency. Since their budgets aren’t like a regular household’s, their policies should not be shaped by fears of a rising national debt. (https://www.investopedia.com/modern-monetary-theory-mmt-4588060)

[iv] “Inflation, An Unworkable Fiscal Policy”, Ludwig von Mises

[v] Shelby Cullom Davis, one of the greatest value investors the world has ever known.

Telos Wealth Management Posted on

Telos Wealth Management Posted on  Monday, March 25, 2024 at 12:18PM

Monday, March 25, 2024 at 12:18PM